Cracking the Code: Your Bank Account Number

In the realm of personal finance, your bank account number is a key player, facilitating a myriad of transactions that range from routine to pivotal. Whether you’re transferring funds to support your family or paying essential bills, this seemingly mundane string of numbers holds the key to unlocking numerous financial operations.

However, despite its pivotal role, the elusive nature of the IBAN (International Bank Account Number) often leaves individuals grappling with questions. Where exactly can you find this numerical identifier when you need it the most? How does it operate, and what do the digits scattered across its sequence signify?

In this article, we will address these questions and empower you with a comprehensive understanding of your bank account number, ensuring that it transitions from a perplexing cipher to a familiar ally in your financial toolkit.

What is your bank account number?

Account numbers are used to identify your account within any existing banking institution. It’s like a passport for your money. This specific sequence of numbers allows third parties (your employer, service providers or other users) to transfer money to you or charge you for services without worrying about sending or billing it to the wrong person.

What is my IBAN code?

The IBAN, an alphanumeric code introduced in 2014 with the implementation of the Single Euro Payments Area (SEPA), serves to uniquely identify a bank account across any financial institution globally, contingent upon the bank’s country supporting the IBAN system.

This system substantially simplifies transfers between users in various countries, eliminating additional fees associated with such transactions. The automatic functionality of the IBAN system negates the need for manual intervention by the bank / EMI , streamlining the process.

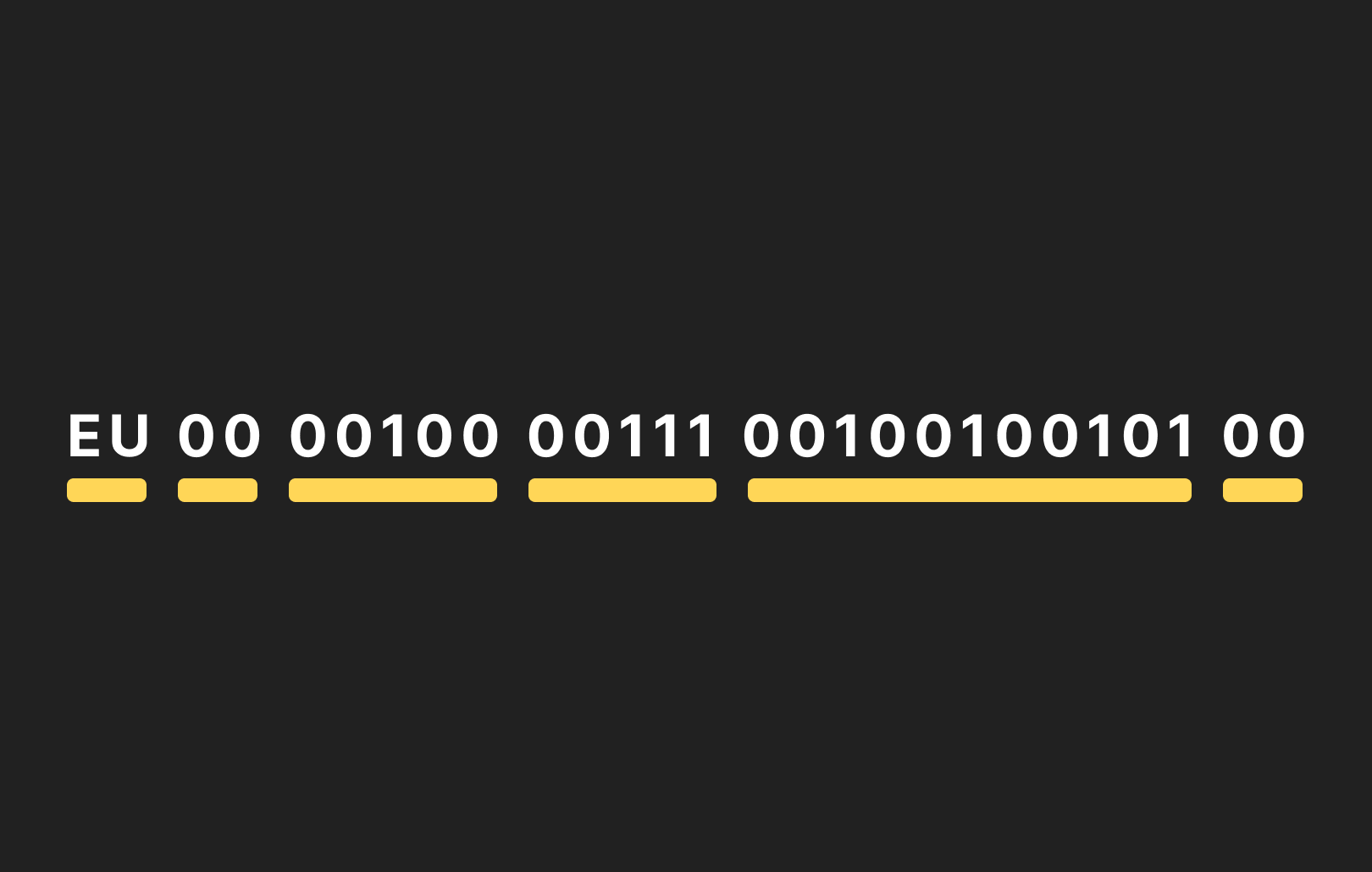

Take a closer look at the image below. An IBAN code adheres to the following structure:

- Two-digit country code, such as “LT.”

- Two check digits code, for instance, “00.”

- Bank identifier code, exemplified by “30600” for Satchel.

- Account number or basic bank account number (BBAN), comprising, for example, 11 digits in Lithuania.

What is the purpose of a bank account number?

As previously explained, your account number holds significant importance in your daily affairs. While there are numerous functionalities associated with your account, some key options include:

- Sending or receiving money, whether in national or international transactions.

- Making payments for services and bills through direct debit, encompassing utilities such as water and electricity, as well as online services like Uber.

- Enabling payments for salaries and various forms of income. In cases where you receive unemployment benefits or financial assistance, public entities may also request your bank account number.

Is my card number identical to my account number?

Perhaps you’ve pondered whether your credit or debit card number corresponds to your bank account number, imagining how convenient that would be. However, while card payments are associated with an account, their numbers are separate and unrelated.

How can I find my IBAN?

Here are some practical steps that will help you find your IBAN:

- Bank’s mobile app / web client office: Check your banking service provider’s mobile application, where the IBAN is typically displayed along with the balance of your personal account, or the web client office that also stores that information.

- Customer service: Contact your bank’s customer service team via phone. They will provide your IBAN upon verifying your identity by requesting you to confirm certain personal information.

- Physical branch: Visit your financial institution’s physical branch. Although not the most convenient option, it is an equally effective method.

- Online IBAN Validation Tools: Utilize online tools designed for IBAN validation.

What is my BIC/SWIFT code?

The BIC (Bank Identifier Code) or SWIFT (Society for World Interbank Financial Telecommunication) is an additional alphanumeric code utilized to identify banking institutions that are not part of the IBAN system, whether for sending or receiving transfers.

This code can consist of either 8 or 11 characters:

- An 8-character code, encompassing information about the bank, country, and location.

- An 11-character code, which contains the same details as the 8-character code but includes three extra numbers for the sort code.

Most financial institutions typically provide these codes within the relevant information on their website, making it easy for you to locate yours through a brief Google search.